colorado springs sales tax calculator

Manufactured homes in Colorado but not other forms of prefabricated housing must be titled with the Colorado Department of Revenue. 010 Trails Open Space and Parks TOPS.

Sales Tax Information Colorado Springs

Counties cities and districts impose their own local taxes.

. US Sales Tax Colorado El Paso Sales Tax calculator Colorado Springs. You can find more tax rates and allowances for Colorado Springs and. Rates are expressed in mills which are equal to 1 for every 1000 of property value.

For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 29. The sales tax rate does not vary based on zip code. Manitou Springs is located within El Paso County Colorado.

Just enter the five-digit zip code of the location in. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The average sales tax rate in Colorado is 6078.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. Maximum Local Sales Tax. I report my gross and net taxable sales for my primary and subsidiary locations by using a schedule C when I file taxes.

Visit the COVID-19 Sales Tax Relief web page for more information and filing instructions. To calculate the sales tax. Companies doing business in Colorado need to register with the Colorado Department of Revenue.

The minimum is 29. Price w tax. Depending on local municipalities the total tax rate can be as high as 112.

The Colorado Springs sales tax rate is 307. All applicable sales andor use taxes must be paid before the Department or. The statewide sales tax in Colorado is just 290 lowest among states with a sales tax.

The GIS not only shows state sales tax information but it also includes sales tax information for counties municipalities and special taxation districts. This information is intended to provide basic guidelines regarding the collection of sales and use tax ownership tax and license fees. The average cumulative sales tax rate in Manitou Springs Colorado is 903.

Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The December 2020 total local sales tax rate was 8250.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Fill in price either with or without sales tax. The current total local sales tax rate in Colorado Springs CO is 8200.

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. If you owe additional tax return the completed form and check payable to The City of Colorado Springs Sales Tax PO Box 1575 Mail Code 225 Colorado Springs CO 80901-1575. Calculator for Sales Tax in the Colorado Springs.

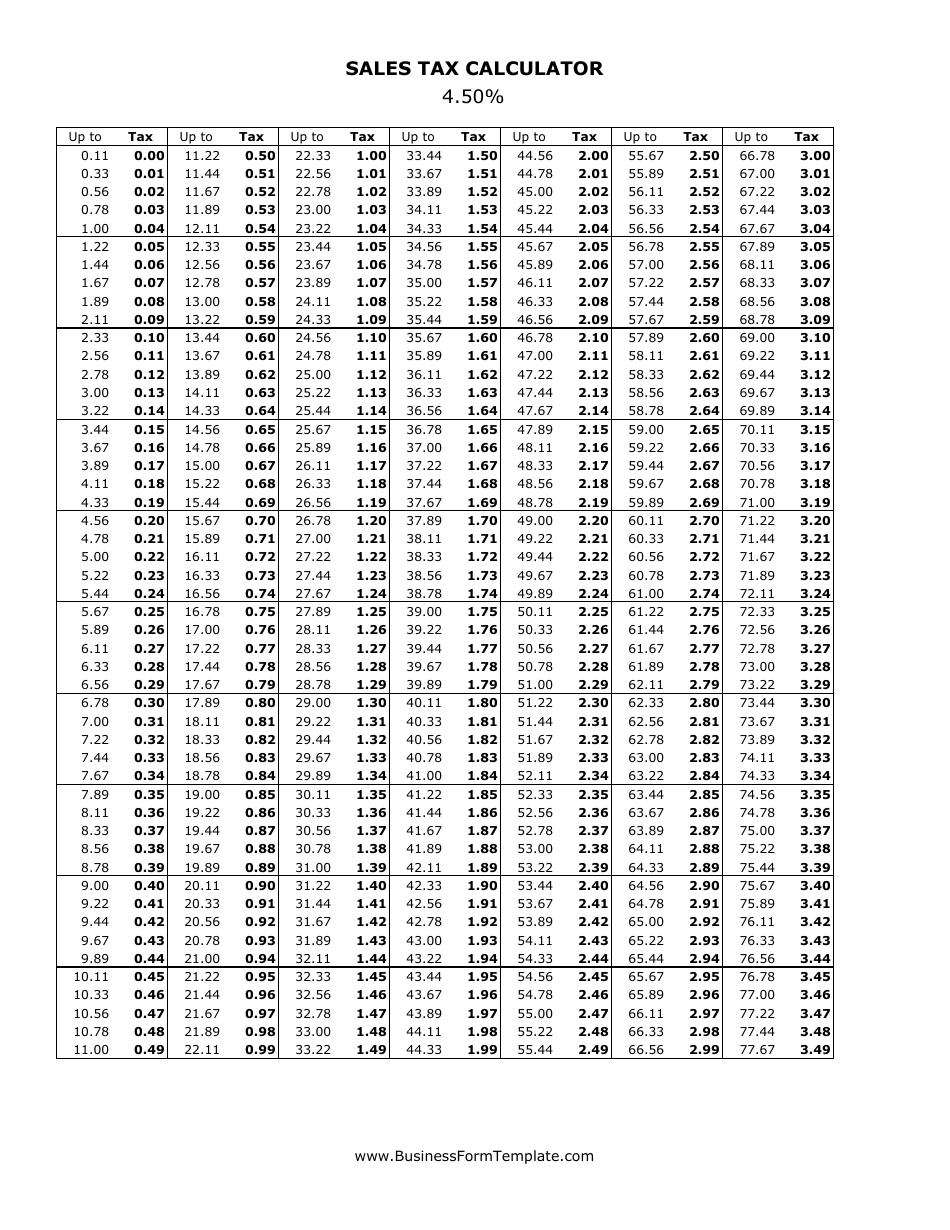

Sales Tax Calculator Sales Tax Table. All numbers are rounded in the normal fashion. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is 82.

Ownership Tax Calculator Estimate ownership taxes. The results are rounded to two decimals. 307 City of Colorado Springs self-collected 200 General Fund.

You can print a 82 sales tax table here. The combined amount is 820 broken out as follows. Method to calculate Colorado Springs sales tax in 2021.

This includes the rates on the state county city and special levels. One of a suite of free online calculators provided by the team at iCalculator. Colorado State Sales Tax.

There is base sales tax by Colorado. Within Manitou Springs there is 1 zip code with the most populous zip code being 80829. Multiply the vehicle price after trade-ins but before incentives by the sales tax fee.

The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. This is the total of state county and city sales tax rates. The Colorado CO state sales tax rate is currently 29.

Average Local State Sales Tax. We are proud to serve the great people of Colorado as efficiently and safely as possible. Colorado Springs was founded 150 years ago on July 31 1871.

Colorado Sales Tax. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 724 in Colorado Springs Colorado. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Colorado has a 29 statewide sales tax rate but also has 276 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4074 on top. Real property tax on median home. For income tax please visit our Colorado Income Tax Rates and Calculator page.

This system allows for. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. If you have overpaid your tax return the.

Groceries and prescription drugs are exempt from the Colorado sales tax. Maximum Possible Sales Tax. What is the sales tax rate in Colorado Springs Colorado.

Did South Dakota v. The County sales tax rate is 123. Sales Tax Table For Colorado Springs Colorado.

Colorado has 560 special sales tax jurisdictions with local sales taxes in. The Colorado sales tax rate is currently 29. However as anyone who has spent time in Denver Boulder or Colorado Springs can tell you actual sales tax rates are much higher in most cities.

The last rates update has been made on July. Fountain Live in Buy in. The trade-in value of your vehicle is 10000 and you.

Motor vehicle dealerships should review the. Sales Tax State Local Sales Tax on Food. For tax rates in other cities see Colorado sales taxes by city and county.

The Colorado Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Colorado Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Colorado Springs Colorado. This is because many cities and counties have their own sales taxes in addition to the.

Tax Credit Calculator Free Tax Filing Irs Taxes Tax Refund

Property Tax Calculator Property Tax Guide Rethority

Airbnb Rules In Colorado Airbnb Laws Taxes And Regulations The Leading All In One Vacation Rental Management Software For Pros Hostaway

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

How Colorado Taxes Work Auto Dealers Dealr Tax

Sales Tax Information Colorado Springs

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Behind The Springs Podcasts Colorado Springs

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

How To Calculate Cannabis Taxes At Your Dispensary

Sales Taxes In The United States Wikiwand

Sales Tax City Of Fort Collins

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Wyoming Sales Tax Small Business Guide Truic

Bankerbhai Expense Inflation Calculator Investment Finance Homeloan Loan Personalloan Fridayfeeling Exitpol Business Tax Financial Planning Tax Prep